Foot Locker Set For India Entry - Top Indian Market Updates

Here are some of the major updates that could move the markets tomorrow:

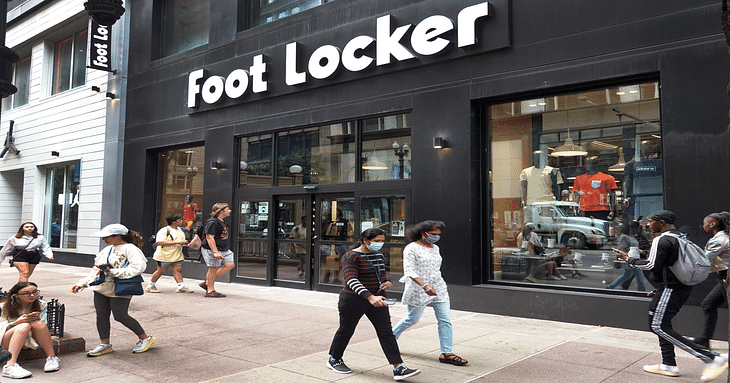

Foot Locker signs pact with Metro Brands, Nykaa for India entry

American sportswear & footwear retailer Foot Locker has signed a long-term licensing agreement with Metro Brands Ltd (MBL) and Nykaa Fashion for its India entry. MBL will have the rights to own and operate Foot Locker stores within India and sell authorised merchandise in Foot Locker stores. Nykaa Fashion will be the exclusive e-commerce partner, operating Foot Locker's India website and retailing authorised merchandise.

Read more here.

Aurobindo Pharma gets USFDA approval for HIV drug

Aurobindo Pharma has received approval from the US Food & Drug Administration (USFDA) to market a generic medication used to treat human immunodeficiency virus (HIV-1) infection. The approval is to manufacture and market Darunavir tablets in strengths of 600 mg and 800 mg. As per IQVIA data, the product has an estimated market size of $274.8 million for the 12 months ended October 2023.

Read more here.

ATGL launches green hydrogen blending pilot in Ahmedabad

Adani Total Gas Ltd (ATGL) has started blending green hydrogen in natural gas they sell to households for cooking purposes and industries as fuel in Ahmedabad. ATGL will employ the latest technologies to blend green hydrogen (GH2) with natural gas for over 4,000 residential and commercial customers in Ahmedabad. The pilot project is expected to be commissioned by Q1 of the financial year 2024-25.

Read more here.

Adani Power to blend green ammonia with coal at Mundra plant

Adani Power Ltd (APL) will use green ammonia along with conventional fuel coal to run the boiler of 330 megawatts (MW) at its Mundra plant in Gujarat. The quantum of green ammonia will be up to 20% of the total fuel requirement. Adani Power has partnered with IHI and Kowa-Japan for the pilot project. They are also examining its expansion to other APL units and stations.

Read more here.

SBI takes possession of PC Jewellers promoters’ assets

State Bank of India has taken possession of two residential properties owned by PC Jewellers Ltd in New Delhi after the firm and its guarantors failed to repay ₹1,168.90 crore. In a notification, SBI cautioned the public not to deal with the property and that any dealings with the property would be subject to the charge of the bank for an amount of ₹1,267 crore. SBI has already filed a case against PC Jewellers in the National Company Law Tribunal.

Read more here.

UltraTech acquires assets of Burnpur Cement for ₹69.79 crore

UltraTech Cement has acquired the cement grinding assets of Burnpur Cement Ltd in Jharkhand for ₹169.79 crore. The company has acquired 0.54 million tonnes per annum (MTPA) cement grinding assets of Burnpur Cement Ltd at Patratu in Jharkhand. Last year, Punjab National Bank had put up for sale the account of loss-making Burnpur Cement and invited bids from Asset Reconstruction Companies (ARCs) to recover loans outstanding of over ₹50 crore.

Read more here.

Report on Zee-Sony merger risks collapse incorrect: ZEEL

Zee Entertainment Enterprises Ltd (ZEEL) called the news report captioned “Sony-Zee Merger Risks Collapse Over Eleventh-Hour CEO Drama: Report” "factually incorrect." The report was published by NDTV. ZEEL is continuing to work towards a successful closure of the proposed merger as per the Composite Scheme of Arrangement approved by NCLT, Mumbai Bench.

Read more here.

Fire reported at Aether Industries’ Surat plant

Aether Industries announced a fire incident at its manufacturing site in Surat, Gujarat. The fire caused injuries to about 25 workers and further evaluation of losses and damages is being conducted. However, no casualties had been reported.

Read more here.

SEBI bans 9 entities from the stock market

The Securities & Exchange Board of India (SEBI) has barred nine entities from the securities market for at least two years and directed them to refund Rs 8 crore collected from investors, which they received via unregistered investment advisory services, within three months. The regulator has also imposed a penalty totalling ₹18 lakh on them and asked them to pay the amount within 45 days.

Read more here.

NSE, BSE grant approval for delisting ICICI Securities shares

ICICI Bank had obtained approval from the National Stock Exchange (NSE) and Bombay Stock Exchange to delist the shares of ICICI Securities. On November 9, the Reserve Bank of India (RBI) granted approval to ICICI Bank, allowing it to establish full ownership of ICICI Securities. On June 26, ICICI Bank disclosed its intention to review a proposal regarding the delisting of ICICI Securities.

Read more here.

Post your comment

No comments to display