Modi's Allies Confirm Support. Can NIFTY Gain Back? - Pre-Market Analysis Report

What Happened Yesterday?

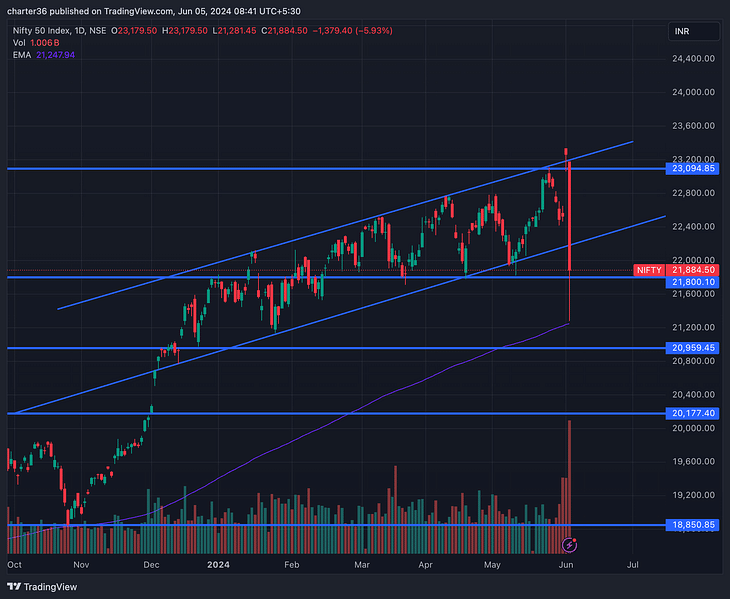

Yesterday was undoubtedly one of the craziest trading days in our stock market's history. It was the biggest single-day fall for NIFTY since March 2020 with even fear of market-wide lower circuit getting triggered at a 10% fall.

NIFTY started yesterday with a gap down at 23,179 and saw a 700+ point fall in 20 minutes. The key trigger was early polling results showing wildly different numbers from the exit poll, and even PM Modi lagging in votes.

After every bounce, there was further selling until the market bottomed out at 21,280. NIFTY ended the day at 21,884, down by 1,379 points or 5.93%.

U.S. markets closed in slight green. The European markets closed in the red.

What to Expect Today?

Asian markets are trading mixed.

The U.S. Futures are trading in green.

GIFT NIFTY is trading in green at 22,061, up by 100 points.

All the factors combined indicate a gap-up opening in the market.

NIFTY has supports at 21,800, 21,480 and 21,270. We can expect resistances at 21,260, 21,400 and 21,870.

BANKNIFTY has supports at 47,200, 46,700 and 46,100. We can expect resistances at 47,600, 48,080 and 48,400.

In NIFTY, there is high call OI resistance at 22,000. Put sellers are active at 21,500. PCR is 0.52, which is indicating high fear.

In BANKNIFTY, there are no significant OI buildups near the current spot price. PCR is at 0.41.

Foreign Institutional Investors net-sold shares worth Rs 12,436 crores. Domestic Institutional Investors net-sold shares worth Rs 3,318 crores.

INDIA VIX shot up 27% to 26.74.

In the first candle of 300+ points fall, it was clear the market was going to swing wildly yesterday. Just when polling started around 9 AM, GIFT NIFTY started falling.

For now, NDA is going to form the government with a 20-seat majority. BJP’s allies have confirmed their support for the formation of a government. However, the market will remain shaky for a while as the BJP is still dependent on its allies.

The market is now technically bearish. NIFTY and BANKNIFTY took good support at their 200-day EMA levels. This level has to be watched as an important indicator of future bearishness.

However, the 200-EMA level is always a good point to buy more based on historical moves. So even if you assume further weakness, I consider it as a good starting point to buy into the market.

Let’s see if NIFTY can crawl its way back into the channel.

We will be continuing to stay out of trading today. You can check out the marketfeed app for new trades!

All the best for the day!

Post your comment

No comments to display