What is Arbitrage Trading & Arbitrage Funds?

Arbitrage trading is the practice of buying shares of a company in one market and selling them in a different one for a profit. Minor pricing discrepancies and inefficiencies exist in the markets and make arbitrage trading possible. In this article, we will understand what arbitrage trading is, how it works, and the different types. We will also understand what arbitrage funds are.

What is Arbitrage Trading?

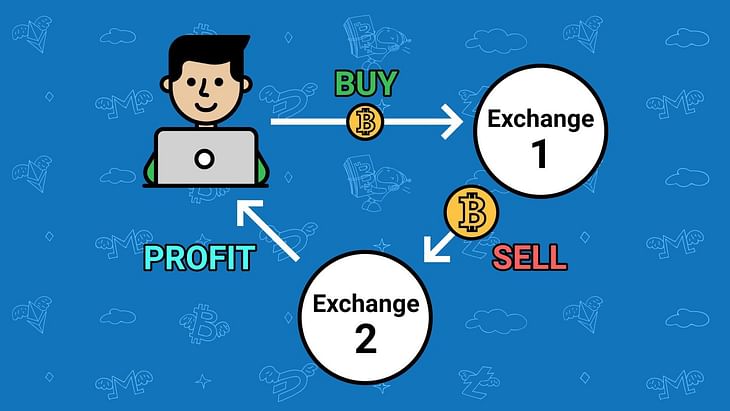

Arbitrage trading is the practice of buying shares of a company in one market and selling it in another market for a profit. In other words, it's a strategy used in the financial markets to profit from price differences/disparities of the same or related assets (stocks, bonds, etc.) in different markets or at different times. The principle behind arbitrage is to buy low in one market and simultaneously sell high in another, thereby locking in a risk-free profit.

In theory, arbitrage trading is a risk-free practice. However, there are some minor practical risks associated with it, such as execution risk, mismatch, and liquidity risk. Arbitrage trades are executed using highly advanced algo-trading systems. Since arbitrage trading demands sophisticated systems, it is primarily carried out by institutional traders (also called arbitrageurs). This is also due to the substantial capital needed to generate a significant profit.

For example: If TCS trades at ₹3605.00 on BSE and ₹3605.50 on NSE, then a trader can buy the stock at ₹3605 from BSE and sell at ₹3605.5 on NSE. The trader can achieve a profit of ₹0.5 from the trade. However, this practice cannot be executed using intraday orders in India.

How Does Arbitrage Trading Work?

Arbitrage can be done whenever any stock, commodity, bond, currency, or other securities are priced differently across markets. In practice, such situations are very rare. Even if such differences arise, market participants exploit the opportunity and remove the discrepancy instantly. Therefore, arbitrage opportunities only last for seconds or even microseconds. Modern technology and High-Frequency Trading (HFT) systems have made it difficult to profit from pricing inefficiencies.

When prices are inefficiently priced, the price of a security will be lower than it actually should be. The difference between the fair value and the current price is an opportunity to exploit. In such situations, institutional traders continuously exploit the gap until it goes away and make it efficiently priced.

Types of Arbitrage Trading Opportunities in India

- Cash and Carry Arbitrage: This practice is performed in one single market. In Cash and Carry Arbitrage, profit is made from the difference in price in the spot market (equity) and futures price. You BUY a certain number of shares equal to the lot size in the spot market and SHORT the futures of the same amount. The difference in price over a period of time is your profit. To learn more about shorting or short-selling, click here.

- Reverse Cash and Carry Arbitrage: This follows an opposite mechanism where you SHORT a certain number of shares equal to the lot size in the spot market and BUY futures of the same amount. Your profit is the difference in price over a period of time.

- Currency Arbitrage: This type of arbitrage is when you take advantage of the price disparity of currency in two markets to book a profit. For example, a bank in New York quotes the currency pair USA/INR 70.20, and a bank in India quotes the same pair 70.94. A trader who is aware of this price difference can perform arbitrage and book profits. There are multiple ways of performing a currency or forex arbitrage, but the essence of it remains the same.

- Inter-Exchange Arbitrage: In this form, you take advantage of the price difference of the same scrip in two different exchanges. Example: TCS is quoting 1202.00 in BSE and 1202.90 in NSE. There are a total of Nine Exchanges recognised by SEBI in India. In India, inter-exchange arbitrage is not possible on intraday orders.

What are the Benefits of Arbitrage?

The benefits of investing in arbitrage funds are:

Low Risk

Arbitrage funds offer investors a low level of risk because they buy and sell each security simultaneously. In ideal situations, market participants instantly lock in profits without taking on any market risk.

Promotes pricing efficiency

Arbitrage trades exploit pricing inefficiencies. Their activities help reduce pricing discrepancies and inefficiencies in the market. Arbitrage trades converge the difference between fair and unfair prices.

Price Discovery

Arbitrageurs play a role in the price discovery process by ensuring that asset prices accurately reflect available information. When prices deviate from their fair values, arbitrageurs step in to correct it.

What are the Risks or Challenges of Arbitrage Trading?

As discussed, profiting from arbitrage is extremely difficult. Although arbitrage is risk-free, there are some risks and difficulties with it.

Execution Risk

Arbitrage strategies require precise and rapid execution. Failing to execute trades at the right moment can result in missed opportunities or losses if prices move against the arbitrageur when delayed.

Difficulty in Tracking

In merger arbitrages, developments are difficult to track as they happen instantly and without prior notice. Additionally, if the news isn't trustworthy and turns out to be wrong, investors who are betting on mergers may lose a lot of money.

Deal Risk

Deal risk is the risk that the merger or acquisition deal does not go through. If it fails, the arbitrageur will lose money.

Arbitrage Funds vs. Other Investment Products

| Arbitrage Funds | Other Investments |

| Aims to generate low risk-free returns consistently | Other products have various objects depending on the investment |

| It is risk-free or near risk-free | Equity funds have high risk while debt funds have lower risks |

| If offers moderately stable and consistent returns | Equity funds offer higher returns but have high volatility. Debt funds have low returns and stability |

| Suitable for short to medium-term investments | Equity funds are suitable for the long term while debt funds are suitable for the short-term |

Arbitrage Trading in Different Financial Markets

Arbitrage trading can be performed in any financial market to exploit pricing inefficiencies. Traders can execute it in the stock market, forex market, commodity market, cryptocurrency market, bond market, and derivatives market.

Regulatory, Tax & Legal Considerations for Arbitrage Trading

Arbitrage trading is legal in India. However, the Securities & Exchange Board of India (SEBI) does not allow buying and selling the same company’s stocks on the same day on different exchanges. Moreover, it is necessary to take delivery of the shares for the trade to be considered legal.

To perform arbitrage trading in India, you need to have the stocks you want to trade in your Demat account. If you see that the stock prices are different on two stock exchanges, you can sell them to make a profit. Afterwards, you can buy the same shares back from the exchange where they are cheaper so that you can complete the transaction. This way, you make money while following the rules set by SEBI.

The tax implications of arbitrage trades are complex as well. Arbitrage is sometimes done simultaneously in different types of securities. For example, in convertible arbitrage, the arbitrageur trades in convertible security and equity of a company simultaneously. Therefore, the taxation varies depending on the type of security.

What are Arbitrage Funds?

Arbitrage Funds are mutual funds that use arbitrage trading to generate wealth. An arbitrage fund is suitable for those investors who want to take advantage of highly volatile markets but have a reduced risk burden. Volatility is what makes arbitrage profitable. Arbitrage funds are subject to the same tax treatment as equity funds (on capital gains). They may have a high expense ratio and are suitable for investors having a short to medium-term horizon of 3 years to 5 years.

In the medium to long term, arbitrage funds are typically known to deliver returns ranging from 7% to 8%. Please make sure you do your own research before investing in an arbitrage fund.

You can check out a number of arbitrage funds and their performance over here.

In conclusion, arbitrage is a complex trading strategy that aims to profit from pricing inefficiencies. It can generate consistent and stable profits without much risk. Moreover, it plays an important role in fixing the pricing inefficiencies in the market. However, it's not feasible for retail traders as arbitrage trading requires sophisticated trading systems to be profitable. You can gain exposure to arbitrage opportunities by investing in an arbitrage fund.

Post your comment

No comments to display