What is Repo-Rate and Reverse Repo-Rate?

What is Repo-Rate?

Repo-Rate is the interest rate at which a central bank (like RBI) lends money to all the other banks in the country. Essentially, all banks give out loans, pay their employees, maintain systems and perform other functions for which they need money.

There are many ways in which a bank earns money, one of them is borrowing from a central bank at a lower interest rate and lending it out in the market at a higher interest rate. The difference between these interest rates becomes their profit.

For example,

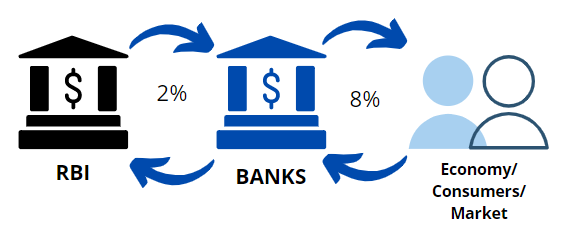

1. The Reserve Bank of India (RBI) lends money to banks at 2% and these very same banks lend out money to the market, which consists of consumers, suppliers, businesses etc.

2. The market uses the money to flourish the economy by scaling up production, increasing revenue and profits and other such activities.

3. Once the market has managed to earn sufficient money, it reciprocates by giving the money back to the banks with an interest of 8% (i.e. 8% more than the money they borrowed from the bank).

4. The bank then goes on to pay back the money to the central bank at 2% interest. The difference between 8% and 2% = 6% is essentially the bank's profit, which it can further lend to the market.

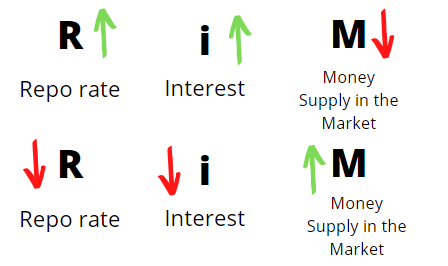

When the central bank increases the repo-rate the interest rate also goes up and the supply of money decreases

When the repo rate decreases the interest rates also decrease and the supply of money in the market increases.

What is Reverse Repo-Rate?

There can always arise a need when there is excess surplus money lying in the market and/or the central bank itself is in need of money, The bank decides on the reverse repo rate or the rate at which other banks lend money to the central bank.

Why is Repo Rate Higher than Reverse Repo Rate?

Banks can park their money with the RBI at a lower interest rate than the Repo Rate or Repurchase Rate. The Reverse Repo Rate is lower than the Repo Rate. The spread between the two is the RBI’s income.